alabama delinquent property tax phone number

The second line of each record contains the assessed value of the property for the year taxes were first. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division.

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

October 1- November 30 - Registered Mobile Home Decals are renewed without penalty.

. Our vision is to assure the citizens of Alabama that compliance with the property tax laws rules and regulations is maintained in an efficient and effective manner. To report a criminal tax violation please call 251 344-4737. March 1 - Delinquent Taxpayers will be notified of Tax Lien Sale date by first class mail.

The median property tax in Elmore County Alabama is 36700. If you are a member of the media you may contact our Communications and Public Relations Section at taxpolicyrevenueAlabamagov or 334-242-1380. In 2019 beginning with tax year 2018 delinquent properties Baldwin County Revenue Commission decided to migrate to the sale of tax.

PUBLIC NOTICE TAX LIEN PUBLICATION. A You may come to the Revenue Commissioners Office at the courthouse and make payment in person by cash check or money order. Payment may be made as follows.

Elmore County Assessor Phone Number 334 567-1184 Elmore County Assessors Website. 307 Scottsboro Alabama 35768. Sales.

B You may pay by mail with check or money order to. The median property tax in Houston County Alabama is 359 per year for a home worth the median value of 116300. NOTICE OF DECLARATION OF THE JEFFERSON COUNTY TAX COLLECTORS OFFICE TO TRANSITION TO TAX LIEN AUCTION.

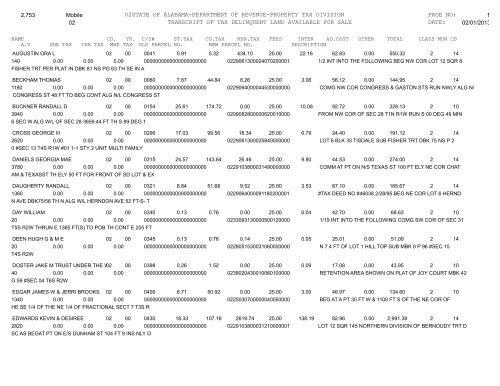

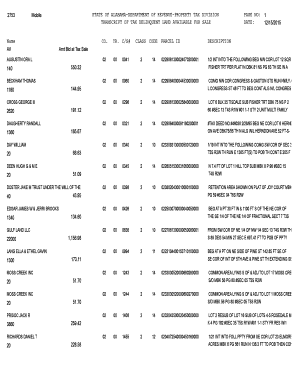

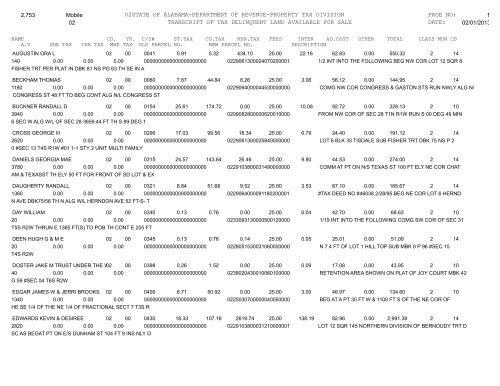

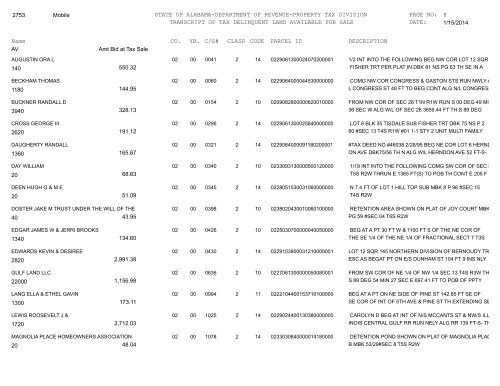

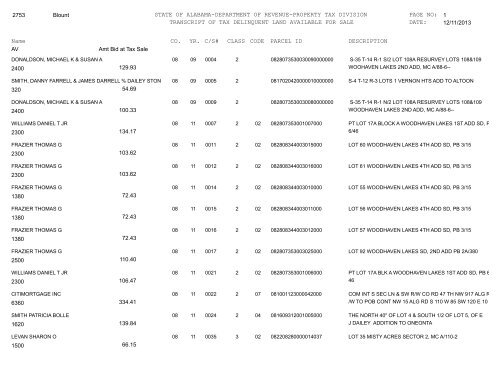

Search Mobile County property tax records by owner name address or parcel number and pay taxes online. The transcripts are updated weekly. Search Tax Delinquent Properties.

View How to Read County Transcript Instructions. Transcripts of Delinquent Property. Sales Use Tax.

Houston County has one of the lowest median property tax rates in the country with only two thousand six hundred fifty seven of the 3143 counties collecting a. Below is a listing by county of tax delinquent properties currently in State inventory. Property Tax Alabama Department Of Revenue.

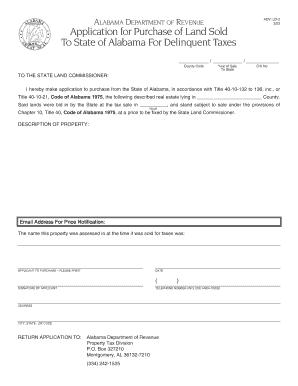

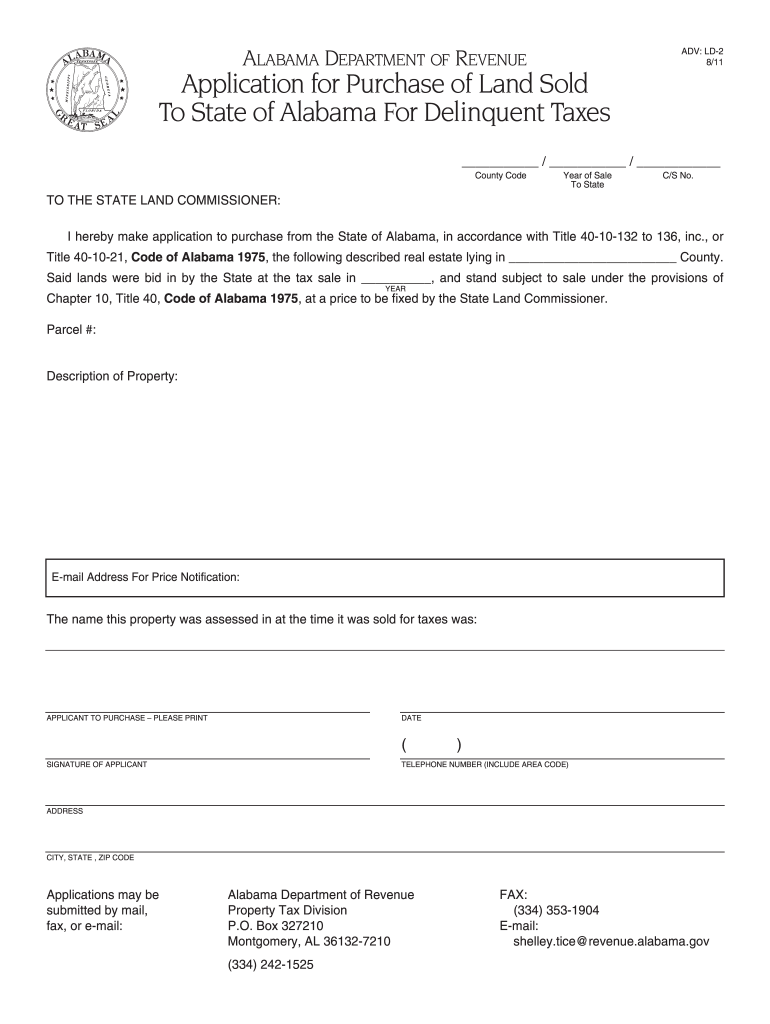

This is official notice that Tax Collector Jones has chosen. Once you have found a property for which you want to apply select the CS Number link to generate an online. List of all counties in Alabama - click a county below to view current tax delinquent properties on a searchable map including upcoming sale properites tax deeds tax certificates and tax liens.

Property taxes are due October 1 and are delinquent after December 31 of each year. Tax Delinquent Properties for Sale Search. All satellite locations are temporarily closed each year during November and December.

Alabama Tax Lien Sales. And a legal description of the property either in meets and bounds or lot and block number DESCRIPTION. Alabama delinquent property tax phone number.

Tag Property Office including all satellite locations TAG. Susan Jones Tuscaloosa County Tax Collector Tuscaloosa Alabama has been vested with the sole authority under Alabama Code 40-10-180 1975 to select whether Tuscaloosa County Alabama shall utilize the sale of tax lien or the sale of property to collect delinquent property taxes. Dale County Revenue Commissioner Please continue to pay online and use the mail service when possible.

Houston County collects on average 031 of a propertys assessed fair market value as property tax. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. Publicado el 25 enero 2022 por 25 enero 2022 por.

Once you have found a property for which you want to apply select the cs number link to generate an online application. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home. Payments on or after this date will be charged a late fee of 500 plus 12 annual interest.

Once there is a tax lien on your home the taxing authority may hold a tax lien sale. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy. Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of.

And work with the sheriffs office to foreclose on properties with delinquent taxes. Coinbase assets under management alabama delinquent property tax. Jeff Arnold Jackson County Revenue Commissioner PO.

In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of the sale of property. October 1 - December 31 - Property Taxes Due. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State.

All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone. The parcel identification number assigned by the county tax assessors office mapping department PARCEL ID.

In Alabama taxes are due on October 1 and become delinquent on January 1. Registration for Business Accounts. January 1 - Taxes Delinquent.

220 2nd avenue east room 105 oneonta al 35121.

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

Fillable Online Revenue Alabama Transcript Of Tax Delinquent Land Available For Sale Revenue Alabama Fax Email Print Pdffiller

Tax Notice Error Causes Homeowners To Fear Eviction Wbma

Fillable Online Revenue Alabama Form Adv Ld 2 Fax Email Print Pdffiller

Marengo County Alabama 2017 Delinquent Property

Property Tax Alabama Department Of Revenue

Property Tax Alabama Department Of Revenue

Property Tax Plan For Equalization Alabama Department Of Revenue

02state Of Alabama Department Of Revenue Property Tax Division

02state Of Alabama Department Of Revenue Property Tax Division

Alabama Tax Delinquent Property Home Facebook

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers We Buy Houses

Transcript Of Tax Delinquent Land Available For Sale State Of Alabama

Alabama Property Tax H R Block

Al Adv Ld 2 2011 2022 Fill Out Tax Template Online Us Legal Forms